What is FreeAgent?

FreeAgent is a cloud-based accounting software platform specifically designed for contractors, freelancers and small businesses in the UK. The software provides a comprehensive solution for managing businesses finances, tax obligations and accounting requirements all in one place.

Many limited companies choose to use FreeAgent due to its user-friendly interface and UK-specific tax features. Enhance your bookkeeping process as soon as possible with Nexus Accounting.

What is FreeAgent?

FreeAgent is a cloud-based accounting software platform specifically designed for contractors, freelancers and small businesses in the UK. The software provides a comprehensive solution for managing businesses finances, tax obligations and accounting requirements all in one place.

Many limited companies choose to use FreeAgent due to its user-friendly interface and UK-specific tax features. Enhance your bookkeeping process as soon as possible with Nexus Accounting.

How Businesses Can Use FreeAgent

We know every business has their own methods of bookkeeping and account management, but with FreeAgent, you can streamline your current accounting process enabling you to focus on other areas of your business. Here are a few examples of the ways FreeAgent accounting can be used in your business:

Daily Financial Management: Businesses can use FreeAgent to record income and expenses, reconcile bank transactions and maintain real-time visibility of their cash position. The intuitive interface makes it easy to stay on top of day-to-day finances without accounting expertise.

Client and Project Management: You can create contacts for clients, track project profitability, monitor billable hours and manage the complete invoicing cycle from estimate to payment. This end-to-end approach helps businesses maintain professional client relationships.

Tax Compliance and Submission: FreeAgent allows you to view your VAT returns, prepare for Self Assessment and estimate your corporation tax liabilities. With the tax timeline feature never miss another deadline.

Payroll Processing: Limited companies can run payroll for directors and employees, calculate PAYE and National Insurance contributions, and generate payslips within the system. This integration keeps all your financial information in one place and ensures payroll-related tax obligations are properly handled.

Financial Planning and Forecasting: Using the reporting tools, you can analyse performance, identify trends and make informed decisions about future investments or expansions. The cash flow projections are particularly valuable for anticipating potential shortfalls or opportunities.

How Businesses Can Use FreeAgent

We know every business has their own methods of bookkeeping and account management, but with FreeAgent, you can streamline your current accounting process enabling you to focus on other areas of your business. Here are a few examples of the ways FreeAgent accounting can be used in your business:

Daily Financial Management:

Businesses can use FreeAgent to record income and expenses, reconcile bank transactions and maintain real-time visibility of their cash position. The intuitive interface makes it easy to stay on top of day-to-day finances without accounting expertise.

Client and Project Management:

You can create contacts for clients, track project profitability, monitor billable hours and manage the complete invoicing cycle from estimate to payment. This end-to-end approach helps businesses maintain professional client relationships.

Tax Compliance and Submission:

FreeAgent allows you to view your VAT returns, prepare for Self Assessment and estimate your corporation tax liabilities. With the tax timeline feature never miss another deadline.

Payroll Processing:

Limited companies can run payroll for directors and employees, calculate PAYE and National Insurance contributions, and generate payslips within the system. This integration keeps all your financial information in one place and ensures payroll-related tax obligations are properly handled.

Financial Planning and Forecasting:

Using the reporting tools, you can analyse performance, identify trends and make informed decisions about future investments or expansions. The cash flow projections are particularly valuable for anticipating potential shortfalls or opportunities.

Elevate Your Bookkeeping with FreeAgent Today

Take your business accounting to the next level with FreeAgent accounting software, the most efficient way to handle your bookkeeping. With detailed training provided at the beginning, you shall instantly see the difference a comprehensive accounting software can make to your account management.

Get in touch with our FreeAgent accountants today and see how you can get set up for free.

Elevate Your Bookkeeping with FreeAgent Today

Take your business accounting to the next level with FreeAgent accounting software, the most efficient way to handle your bookkeeping. With detailed training provided at the beginning, you shall instantly see the difference a comprehensive accounting software can make to your account management.

Get in touch with our FreeAgent accountants today and see how you can get set up for free.

FAQs

Yes, FreeAgent is fully recognised by HMRC as an approved Making Tax Digital (MTD) software provider for VAT, Income Tax Self Assessment and Corporation Tax. The platform maintains direct digital links with HMRC systems, allowing for compliant tax submissions and communications without leaving the software.

FreeAgent is a comprehensive cloud-based accounting software that helps businesses manage their accounts. Here are just a few examples of what FreeAgent can do for your business: Invoicing Expense Tracking Project Management Payroll Tax Calculations Financial Reporting Imports Bank Transactions Creates Professional Invoices Calculates Tax Obligations Provides Real-Time Financial Insights Enables Direct Tax Submissions to HMRC

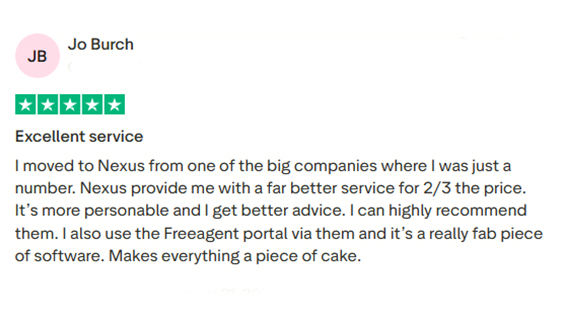

While FreeAgent significantly simplifies bookkeeping and provides everything you need to handle day-to-day accounting tasks, most users shall still benefit from an accountant’s expertise for tax planning, compliance reviews and year-end processes. At Nexus Accounting, we work collaboratively with you through FreeAgent and other accounting software so we can have access to your real-time financial data, provide guidance remotely and advise you on next steps with ease.