Expert Advice – Unlimited Support

At Nexus Accounting, we specialise in tax and accounting services for limited companies including contractors and freelancers.

Whether you are a start-up or an established business in the industry, we strive to support you with your finances to ensure you comply with legal requirements and can spend your time focusing on other aspects of your business.

Our team of qualified professionals bring extensive experience across a wide range of industries, allowing us to confidently navigate complex business structures and financial requirements.

Learn more about how we can support you and get in touch with our qualified accountants today for an easier way of accounting.

Expert Advice – Unlimited Support

At Nexus Accounting, we specialise in tax and accounting services for limited companies including contractors and freelancers.

Whether you are a start-up or an established business in the industry, we strive to support you with your finances to ensure you comply with legal requirements and can spend your time focusing on other aspects of your business.

Our team of qualified professionals bring extensive experience across a wide range of industries, allowing us to confidently navigate complex business structures and financial requirements.

Learn more about how we can support you and get in touch with our qualified accountants today for an easier way of accounting.

What We Do: Our Online Accountancy Services

We help Contractors, Freelancers and small businesses in various industries with all their accounting and tax planning needs. We take care of the registrations, deadlines, and filings, so you remain compliant and in control.

Contractors

Navigating finances as a contractor can be complicated with the additional legal obligations you face. From IR35 advice to VAT management and financial planning, our online accountancy services are here to answer all your questions and keep track of your finances so you can get the most out of your take home pay.

Freelancers

Freelancing can come with many obstacles that other types of roles might not face. From searching for new clients to handling varying workloads, as a freelancer, it can often be difficult to manage your work as well as your finances. With Nexus Accounting, you can focus on your job while we handle your bookkeeping and tax planning.

Small Businesses

As a small business it can be difficult to juggle all the roles you have to play. At Nexus Accounting, we can help by taking the accounting side of things off your hands. With tax obligations, financial management and strategic planning to think about, we can support you by offering comprehensive accountancy services tailored to your business needs.

What We Do: Our Online Accountancy Services

We help Contractors, Freelancers and small businesses in various industries with all their accounting and tax planning needs. We take care of the registrations, deadlines, and filings, so you remain compliant and in control.

Contractors

Navigating finances as a contractor can be complicated with the additional legal obligations you face. From IR35 advice to VAT management and financial planning, our online accountancy services are here to answer all your questions and keep track of your finances so you can get the most out of your take home pay.

Freelancers

Freelancing can come with many obstacles that other types of roles might not face. From searching for new clients to handling varying workloads, as a freelancer, it can often be difficult to manage your work as well as your finances. With Nexus Accounting, you can focus on your job while we handle your bookkeeping and tax planning.

Small Businesses

As a small business it can be difficult to juggle all the roles you have to play. At Nexus Accounting, we can help by taking the accounting side of things off your hands. With tax obligations, financial management and strategic planning to think about, we can support you by offering comprehensive accountancy services tailored to your business needs.

Benefits of Working with Specialist Accountants

Our monthly package offers a comprehensive service for a low cost monthly subscription which includes FreeAgent Cloud Accounting software.

Benefits of Working with Specialist Accountants

Our monthly package offers a comprehensive service for a low cost monthly subscription which includes FreeAgent Cloud Accounting software.

Accounting Made

Simple

If you are searching for an experienced online accounting firm to handle your finances, look no further than Nexus Accounting.

Our finance experts have years of experience working in your industry meaning they are equipped with the knowledge to handle complex business structures and requirements. Get in touch with our team today to experience accounting made simple.

Accounting Made

Simple

If you are searching for an experienced online accounting firm to handle your finances, look no further than Nexus Accounting.

Our finance experts have years of experience working in your industry meaning they are equipped with the knowledge to handle complex business structures and requirements. Get in touch with our team today to experience accounting made simple.

FAQs

While you are not legally required to have a business accountant, an accountant can help you save money by optimising tax strategies and prevent costly compliance errors. At Nexus Accounting, we can support you by freeing up your time to grow your business rather than trying to navigate complex financial regulations.

Bookkeeping involves recording daily financial transactions and maintaining basic financial records like receipts, invoices and bank statements. On the other hand, accounting builds on this foundation by analysing financial data, preparing formal statements, offering strategic business advice and ensuring tax compliance. Our comprehensive accounting package covers both bookkeeping and wider accounting services to ensure all your finances are handled under one roof.

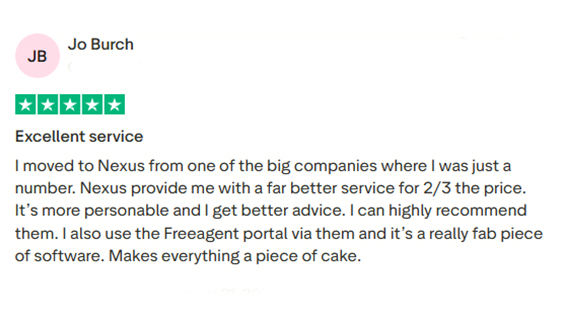

It is your responsibility to keep your book keeping records up to date and this can be done with ease with FreeAgent book keeping and accounting software.

Your accountant shall always be on hand to help guide you and ensure you maximise your tax efficiency.