Accountants for Medical Professionals

Locum healthcare professionals have roles that are unlike any other. As temporary medical professionals, it can be hard to not only manage your finances but also find someone who has the knowledge to handle such unique circumstances. That’s where we come in.

At Nexus Accounting, we offer specialised accounting services that are specifically designed to support doctors, pharmacists and opticians working in locum positions.

With our help, you can experience comprehensive bookkeeping and tax efficiency all while you focus on delivering exceptional patient care. Learn more about our accountancy services for medical professionals and get in touch with our team to see how we tailor our package to support you.

Accountants for Medical Professionals

Locum healthcare professionals have roles that are unlike any other. As temporary medical professionals, it can be hard to not only manage your finances but also find someone who has the knowledge to handle such unique circumstances. That’s where we come in.

At Nexus Accounting, we offer specialised accounting services that are specifically designed to support doctors, pharmacists and opticians working in locum positions.

With our help, you can experience comprehensive bookkeeping and tax efficiency all while you focus on delivering exceptional patient care. Learn more about our accountancy services for medical professionals and get in touch with our team to see how we tailor our package to support you.

Our Medical Professionals Accounting Service

If you are a locum medical professional looking for a comprehensive accounting package, we can help! We understand the distinctive challenges locum professionals face. In fact, our team of expert accountants have handled numerous accounts over the years in a similar position to you, meaning you can trust us to take care of your finances.

Why Nexus Is the Right Choice for Medical Professionals

Time Saving Financial Management

As a locum, your time is highly valuable and you don’t want to be spending it navigating the complexities of taxes and financial planning. Our efficient systems minimise your financial management burdens, giving you the time to focus on clinical work and get some well-deserved rest.

Expertise in Locum Healthcare Finances

Our team of specialist accountants have years of experience working with locum healthcare professionals, understanding the complexities of working across multiple sites, dealing with various payment systems and managing irregular income streams. This specialist knowledge ensures you receive advice that’s tailored to your needs.

IR35 Protection and Guidance

Locum professionals face increasing scrutiny under IR35 regulations. Our expertise helps determine your employment status, structure contracts appropriately and maintain proper documentation to protect your self-employed status where applicable, reducing significant tax risks.

Financial Clarity During Variable Income

With the financial data we accumulate, we can help you establish robust financial systems that provide greater financial clarity despite the irregular income patterns common in locum work. Our planning tools and strategies help you manage tax reserves, identify more profitable assignments and ensure greater financial stability throughout the year.

Connect with Expert Medical Professional

Accountants Today

Whether you are a locum doctor, pharmacist, optician or other medical professional, our specialist accountants are on hand to help you organise your finances. Experience the peace of mind that comes from working with accountants who truly understand the unique financial challenges of locum healthcare professionals today by getting in touch with our team!

Connect with Expert Medical Professional Accountants Today

Whether you are a locum doctor, pharmacist, optician or other medical professional, our specialist accountants are on hand to help you organise your finances. Experience the peace of mind that comes from working with accountants who truly understand the unique financial challenges of locum healthcare professionals today by getting in touch with our team!

Get in Touch with Expert Accountants for Medical Professionals Today

Whether you are a locum doctor, pharmacist, optician or other medical professional, our specialist accountants are on hand to help you organise your finances. Experience the peace of mind that comes from working with accountants who truly understand the unique financial challenges of locum healthcare professionals today by getting in touch with our team!

Get in Touch with Expert Accountants for Medical Professionals Today

Whether you are a locum doctor, pharmacist, optician or other medical professional, our specialist accountants are on hand to help you organise your finances. Experience the peace of mind that comes from working with accountants who truly understand the unique financial challenges of locum healthcare professionals today by getting in touch with our team!

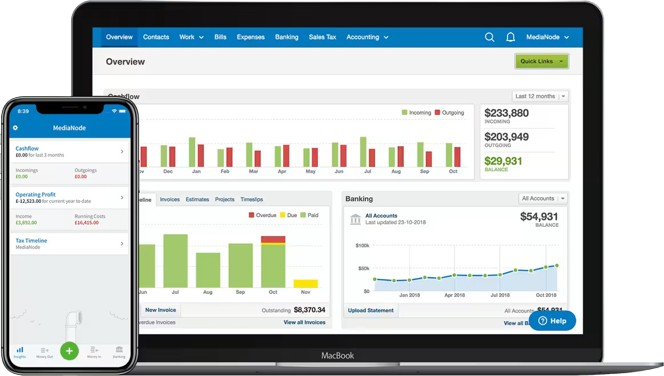

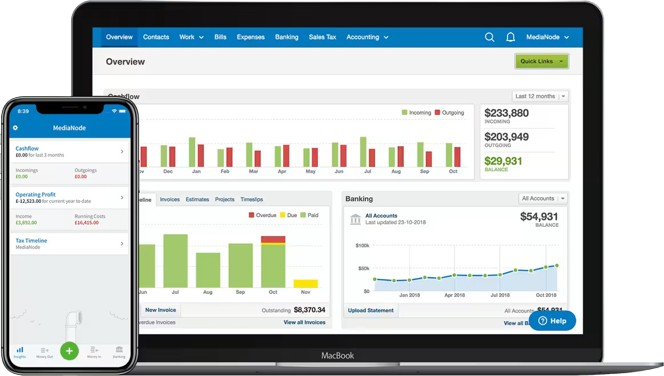

Unrivalled Medical Professional Accountancy Software

FreeAgent is an incredibly simple and effective cloud based accounting solution, which removes the hassle of bookkeeping and provides the information that you need at your fingertips.

Run your entire business from anywhere. Snap an expense, create an invoice, check your cashflow, and stay on top of your tax. Your qualified accountant will help set you up and provide a full walk through of how to make the most of FreeAgent.

Please contact us for a free demonstration.

Unrivalled Medical Professional Accountancy Software

FreeAgent is an incredibly simple and effective cloud based accounting solution, which removes the hassle of bookkeeping and provides the information that you need at your fingertips.

Run your entire business from anywhere. Snap an expense, create an invoice, check your cashflow, and stay on top of your tax. Your qualified accountant will help set you up and provide a full walk through of how to make the most of FreeAgent.

Please contact us for a free demonstration.

Medical Professional Accountants FAQs

Yes, locum healthcare professionals can typically claim mileage and travel costs between different work locations, though not for regular commuting to a single base. We help establish clear systems and advise on maximising legitimate travel claims while avoiding common HMRC red flags related to itinerant working patterns.

The optimal structure depends on your specific circumstances, including income level, expense patterns, and long-term plans. Generally, limited companies become more advantageous at higher income levels, though recent tax changes and IR35 considerations have shifted this threshold and made the decision more nuanced for healthcare professionals. For further advice and support on this matter, get in touch with our team today!

IR35 rules can significantly impact locums, particularly those working through limited companies or agencies. Since April 2021, large private healthcare providers (like many hospital groups) determine your IR35 status alongside NHS organisations. We help assess your working arrangements, structure contracts appropriately where possible, and adjust your financial planning to mitigate IR35 implications.